2028 Mortgage Renewal Canada: Navigating the upcoming renewal period requires careful planning. Interest rates are a big unknown, influenced by everything from Bank of Canada policy to global economic trends. This guide helps you understand potential rate changes, explore different renewal strategies, and prepare for what might lie ahead. We’ll cover key factors affecting renewals, explore options like refinancing and porting, and even look at how to best work with a financial advisor.

Planning for your 2028 mortgage renewal in Canada? It’s smart to start thinking about it now. You might even find yourself needing a bit of extra cash, like if you were, say, investing in a cool new piece of tech, such as the super scooper drone. But back to your mortgage – secure your future by comparing rates and options well in advance of your renewal date.

Understanding the potential challenges and opportunities associated with renewing your mortgage in 2028 is crucial for financial stability. This involves analyzing predicted interest rate ranges, identifying key economic indicators that might impact your renewal, and exploring various strategies to manage your mortgage effectively. We’ll delve into the specifics of these factors, providing you with a comprehensive overview to make informed decisions.

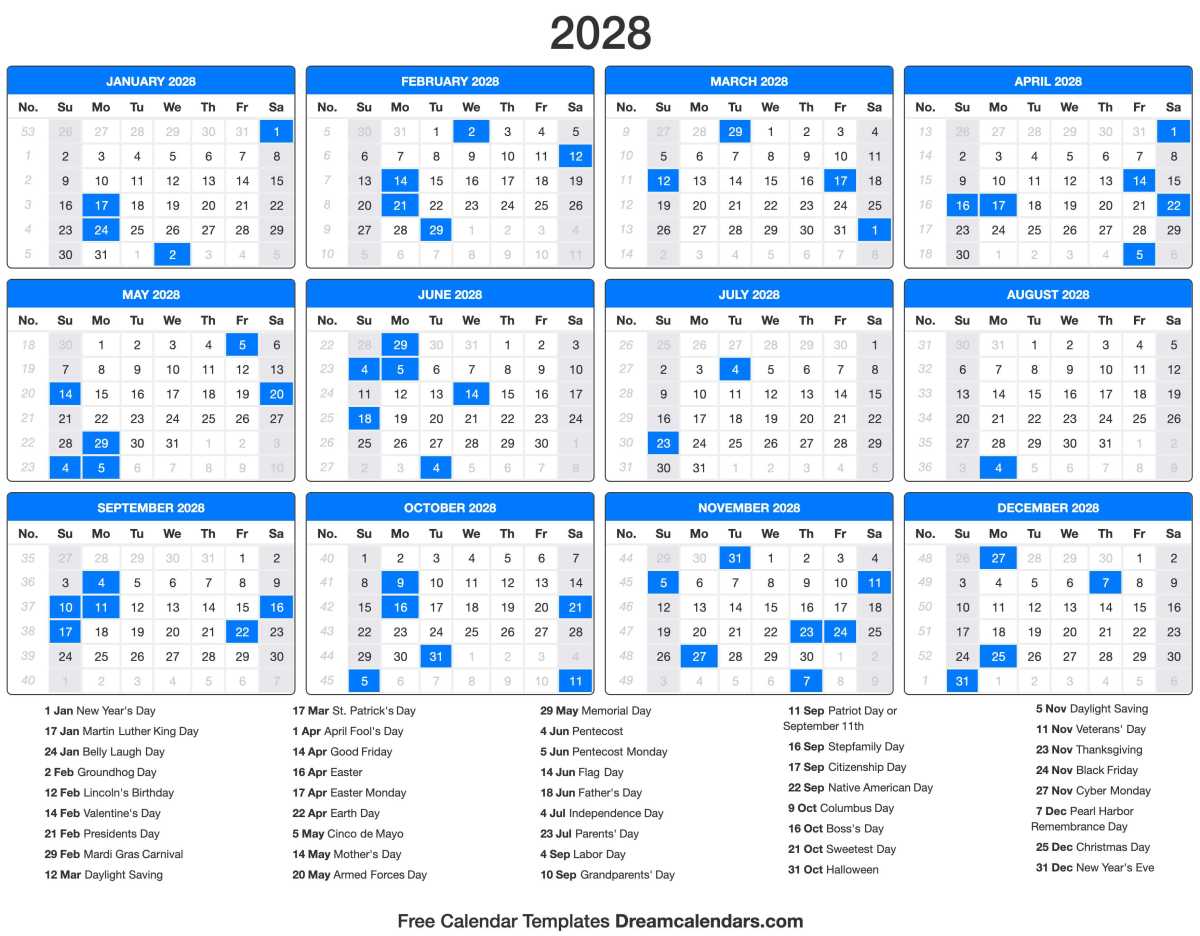

Canadian Mortgage Rates in 2028

Predicting mortgage rates for 2028 requires considering various economic factors, including inflation, economic growth, and Bank of Canada policies. While precise prediction is impossible, we can explore potential scenarios based on optimistic, pessimistic, and baseline forecasts to offer a clearer picture for homeowners.

Potential Mortgage Interest Rate Ranges in 2028

Several factors influence the range of potential mortgage interest rates in Canada for 2028. An optimistic scenario assumes sustained economic growth and controlled inflation, potentially leading to lower rates. A pessimistic scenario considers factors like a recession or persistent high inflation, resulting in higher rates. A baseline scenario represents a more moderate outlook, balancing optimistic and pessimistic factors.

Comparison of Potential Rate Scenarios

The following table illustrates potential rate ranges under different economic scenarios for various mortgage terms. These are illustrative examples and actual rates may vary depending on lender policies and individual circumstances.

| Scenario | 5-Year Rate | 10-Year Rate |

|---|---|---|

| Optimistic | 4.5% – 5.5% | 5.0% – 6.0% |

| Baseline | 6.0% – 7.0% | 6.5% – 7.5% |

| Pessimistic | 7.5% – 8.5% | 8.0% – 9.0% |

Influence of Bank of Canada Policies

The Bank of Canada’s monetary policy significantly impacts mortgage rates. For example, raising the policy interest rate generally leads to higher borrowing costs, including mortgages. Conversely, lowering the rate can make mortgages more affordable. Predicting the Bank of Canada’s actions in 2028 requires analyzing inflation trends, economic growth projections, and other macroeconomic indicators. Historically, the Bank has responded to high inflation by increasing rates, and to economic slowdowns by decreasing them.

Planning for your 2028 mortgage renewal in Canada? It’s smart to start thinking about it now! While you’re strategizing your finances, maybe take a quick break to check out some exciting hockey news – like this article on connor mcdavid auston matthews and their upcoming season. Then, get back to focusing on securing the best rates for your 2028 mortgage renewal.

Don’t procrastinate!

Therefore, the 2028 rate will largely depend on the economic climate at that time.

Factors Affecting 2028 Mortgage Renewals: 2028 Mortgage Renewal Canada

Several key economic indicators and policy changes will significantly influence mortgage renewal rates and decisions in 2028. Understanding these factors is crucial for homeowners preparing for their renewals.

Key Economic Indicators Impacting Mortgage Renewal Rates

Inflation, interest rate fluctuations, and overall economic growth are the primary drivers of mortgage renewal rates. High inflation erodes purchasing power, making it harder for homeowners to manage increased mortgage payments. Changes in government housing policies, such as stress tests or changes to mortgage insurance programs, also directly impact affordability and renewal options. The strength of the Canadian dollar relative to other currencies can also indirectly influence mortgage rates by affecting the cost of borrowing internationally.

Impact of Inflation on Mortgage Affordability

High inflation directly impacts mortgage affordability. As prices rise, incomes may not keep pace, squeezing household budgets. This can lead to difficulties in managing increased mortgage payments during renewal, potentially forcing homeowners to consider options like refinancing or downsizing.

Influence of Government Housing Policies

Government interventions in the housing market significantly influence mortgage renewals. Changes in stress test requirements, mortgage insurance premiums, or regulations surrounding lending practices directly impact borrowing costs and affordability. For example, stricter stress tests can make it harder for some homeowners to qualify for a new mortgage at renewal, potentially limiting their options.

Potential Challenges for Homeowners During 2028 Renewals

- Higher interest rates leading to significantly increased monthly payments.

- Difficulty qualifying for a new mortgage due to stricter lending criteria.

- Limited options for refinancing or porting due to market conditions.

- Increased competition among lenders potentially leading to less favorable terms.

- Uncertainty surrounding future economic conditions and interest rate fluctuations.

Strategies for Managing 2028 Mortgage Renewals

Proactive planning is crucial for navigating the 2028 mortgage renewal landscape. Homeowners should explore various strategies to mitigate potential risks and secure the most favorable terms.

Step-by-Step Guide for Preparing for Mortgage Renewal

- Assess your current financial situation: Review your income, expenses, and debt levels.

- Monitor interest rates: Stay informed about market trends and predict potential rate changes.

- Explore renewal options: Research refinancing, porting, or renewing with your current lender.

- Shop around for the best rates: Compare offers from multiple lenders.

- Consult a financial advisor: Seek professional advice to make informed decisions.

Mortgage Renewal Options for Canadian Homeowners

Canadian homeowners have several options when renewing their mortgages, including refinancing, porting, and simply renewing with their current lender. Refinancing involves obtaining a new mortgage with different terms, potentially securing a lower interest rate or changing the amortization period. Porting allows transferring your existing mortgage to a new property. Renewing with the current lender can offer convenience but may not always provide the best rates.

Comparison of Fixed-Rate vs. Variable-Rate Mortgages

| Feature | Fixed-Rate Mortgage | Variable-Rate Mortgage |

|---|---|---|

| Interest Rate | Locked in for the term | Fluctuates with market conditions |

| Predictability | High | Low |

| Potential Savings | Lower if rates decrease during the term | Higher if rates decrease during the term |

| Potential Risk | Higher if rates decrease significantly | Higher if rates increase significantly |

Impact on Homeowners

Higher mortgage rates in 2028 will have significant financial implications for many Canadian homeowners. Understanding these potential impacts is crucial for budgeting and financial planning.

Financial Implications of Higher Mortgage Rates

Increased mortgage payments directly reduce disposable income, potentially affecting household budgets and spending habits. Homeowners may need to adjust their lifestyle, cut back on non-essential expenses, or explore additional income streams to manage higher payments. The impact will vary depending on factors like the size of the mortgage, the interest rate increase, and the homeowner’s income and overall financial situation.

Planning for your 2028 mortgage renewal in Canada? It’s smart to start thinking about it now! You might need to explore different financial options, and checking out resources like the financial planning advice available through kit karzen could be helpful. Understanding your options early will give you a head start in navigating the 2028 mortgage renewal process smoothly.

Differential Impact Across Income Levels

Higher mortgage rates disproportionately affect lower-income homeowners. Those with lower incomes and higher debt-to-income ratios will face a greater financial strain. They may be more vulnerable to financial hardship, potentially leading to difficulties in meeting their mortgage obligations.

Hypothetical Case Study

Consider a homeowner with a $500,000 mortgage at a 5% interest rate. If the rate increases to 7%, their monthly payments will significantly increase, even with a fixed amortization period. This could lead to budget constraints, requiring the homeowner to make adjustments to their spending habits or seek additional income to maintain financial stability.

The Role of Financial Advisors

Seeking professional financial advice is highly recommended when preparing for a 2028 mortgage renewal. A qualified advisor can provide valuable guidance and support throughout the process.

Value of Professional Financial Advice, 2028 mortgage renewal canada

Financial advisors offer expertise in navigating complex mortgage options and market conditions. They can help homeowners assess their financial situation, explore different renewal strategies, and choose the most suitable option based on their individual needs and risk tolerance. They can also provide insights into potential future interest rate movements and their impact on the homeowner’s financial health.

Services Provided by Financial Advisors

Financial advisors can help homeowners with various aspects of mortgage renewal, including assessing affordability, comparing mortgage rates and terms, negotiating with lenders, and developing a comprehensive financial plan to manage increased payments. They can also provide support in exploring alternative options such as refinancing or debt consolidation.

Finding a Reputable Financial Advisor

When choosing a financial advisor, look for professionals with experience in mortgage planning and a strong track record. Check their credentials, seek recommendations from trusted sources, and verify their licensing and affiliations. Ensure the advisor is fee-based and transparent about their compensation structure.

Checklist of Questions for Financial Advisors

- What are your fees and how are they structured?

- What is your experience with mortgage renewals?

- What strategies do you recommend for managing my mortgage renewal?

- What are the potential risks and benefits of different renewal options?

- How will you help me navigate potential challenges during the renewal process?

Last Word

Renewing your mortgage in 2028 will require proactive planning and a clear understanding of the economic landscape. By considering potential rate fluctuations, exploring various renewal options, and seeking professional financial advice, you can navigate this process confidently. Remember, preparation is key to securing the best possible mortgage terms and ensuring your financial well-being in the years to come. Don’t wait until the last minute – start planning now!

Helpful Answers

What if I can’t afford my higher mortgage payments in 2028?

Talk to your lender ASAP. Options like refinancing, extending the amortization period, or switching to a variable rate (if you have a fixed rate) might be available. A financial advisor can also help explore solutions.

How far in advance should I start planning my 2028 renewal?

Ideally, begin planning 6-12 months before your renewal date. This gives you ample time to research rates, compare lenders, and make informed decisions.

What documents do I need to prepare for mortgage renewal?

Gather your current mortgage documents, proof of income, credit report, and any other financial statements your lender requests.

Can I port my mortgage to a new home in 2028?

Yes, porting is an option if you’re buying a new home. Check with your lender to see if it’s feasible and what conditions apply.